Would you take a moment to look at this Balance Sheet? It’s of People’s Bank of China, the central bank at the end of last year (in trillion RMB).

Several items make it a bit unusual. For example, there’s a RMB 4.6 trillion bond issuance. Why not printing money instead?

Anyway, that’s not I want to tell.

What really sets it apart is that 2/3 of the assets are foreign assets, mainly U.S. treasury, in amount of $2 trillion.

This is the result of the trade (im)balance that raised much controversy. Some guys whine that the U.S. people borrowing too much from China and living beyond their means. Meanwhile, they complain that banks are not lending. Urh?

Anyway, that’s not I want to tell.

Image that you are a central banker of China, you will be equally painful. The trade surplus has shot up in recent years, almost $300 billion last year. When some toy makers turn in their hard earned US dollars, you have to hand them RMB in return. The good part is that you can just print the RMBs for the dollars, but the bad part is doing it forces monetary expansion, or it is inflationary.

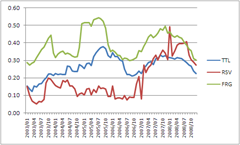

The chart shows the yoy growth of foreign exchange (FRG), total assets (TTL) and reserves (Reserve). Why it has not led to inflation rate as high?

Recoup

This is so weird. China is lending out more money to the U.S. while painfully flooded by more money at the same time?

What the heck is happening? Where did all the money come from?

Something is wrong. Helps needed. Anyone?

No comments:

Post a Comment