Warning: this is only another uneducated speculation easily found on, well, the Internet.

The administration announced today to convert the $25 billion preferred shares of Citigroup (C) into common, thus owning 36% of the company. Other preferred holders with a face worth of $27.5 billion will do the same.

If obtaining shareholders’ approval of the conversion (very likely), the ownership structure would be:

The conversion price is $3.25, while the market closed at $1.5 (down 39%). C is valued at $70 bn at the conversion price and $32 bn at the closing price.

I will do a quick calculation for justification.

Here’s the balance sheet of 3Q2008 and loss estimation.

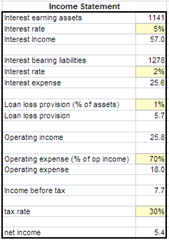

Here’s an income statement based on the balance sheet adjusted after loss.

I know, things are missed out and the numbers are highly subjective (and historically conservative). Even though, assuming C will spend first 5 years on the built-up capital base and grow with the economy, it is worth at least $50 billion, or 10X P/E.

What makes it difficult is the known unknowns of what the administration will do to the troubled assets, and how long will the government hold the shares before re-privatization.

Will the administration lose money on this one? I seriously doubt it, or people will be mad and the President unhappy.

If that’s what you believe (i.e., the administration will sell out above $3.25 when the market allows), the answer would be a lot easier: buy the shares, guess when re-privatization will happen and calculate the expected return. For example, if the administration takes it at $3.25 now (why?) and sells after 3 years at par, you will have a 30% annual return.

Conclusion: pile in and expect someone to pull it off.

P.S., I can’t explain why the sell-off today. There are a lot of smart guys out there.

No comments:

Post a Comment