This is a quick valuation of Fannie Mae (FNM).

Stock Performance

The market value of Fannie has been almost wiped out by the Great Recession (who dubbed it?) .

Recent performance has been strong however and it caught my attention – usually I like seeing plummeting stock prices because ascending price of stocks I don’t own feel like a loss. Greed…

The market cap was $2.4 bil as of last Friday.

What It Does and How It Makes Money

The short answer is I have no idea, but this is what I will tell you if I try: it buys mortgage loans from 1,000 banks, thrifts, credit unions, and other mortgage originators, packs them into MBSs (mortgage backed securities), and then distributes them back into the market (the so-called securitization process) as well as keep some on its own book.

It makes money in primarily two ways:

1) for the mortgage loans/securities it keeps on its own book, it earns the net interest yield, i.e., the interest spread between the interest it collects from the mortgages and the funding interest it pays.

2) for the MBS securities it distributes out, it collects a guaranty fee by presumably guarantees the return, as in an insurance policy.

In both cases, it has to face the default risk when borrowers cannot repay its mortgages.

The above is a 5-year financial summary.

What’s worth noticing first is the sheer size of its mortgage book – around $800 bil held on the B/S and another $2.2 tril guaranteed, or $3 trillion in total. It represents earning power as well as risks, so that if 1% is written off, it’s $30 bil loss.

The next thing is the net interest yield and guaranty fee rate, both of which have been trending down before trending up. It’s a long story to explain the swing. But anyway, the 2008 net interest yield was 1.03%, and guaranty fee rate was 31 bps (or 0.31%).

2008 Losses

A key question of the valuation is how much losses Fannie would incur before the mortgage market normalizes. It’s hard to define what the norm is, but we shall look into the $60 bil loss in 2008 for some clues.

A break-down of the big item 2008 losses: $7 bil in Investment losses, $20 bil in Fair value losses and $30 bil in Credit-related losses.

The 2008 A/R says that the $7 bil investment losses was all due to sub-prime and Alt-A. I will assume it would not happen again in the recent future.

The $20 bil fair value losses was primarily due to interest rate swap, in which Fannie locked in the funding rate to mitigate interest rate risk before the market rate fell. It’s a loss on opportunity cost and it can be factored into the valuation through net interest yield.

The true loss came from the $30 bil credit-related losses, caused by the recent housing market turmoil and reckless lending/borrowing. Though it was about 0.83% of total guaranty book, the 20.76% nonperforming loan ratio was frightening.

2009 1H Losses

Fannie lost another $38 bil in the first half of 2009. Brutal as it was, the glimmer of hope is that the net interest yield improved to 1.69%, and credit-related losses stabilized in the second half.

Conservatorship

Fannie Mae is currently under conservatorship. Financially, it means that the Treasury Department owns $35 bil senior preferred along with warranty to purchase 79.9% of common at zero cost ($0.0001 to be exact).

Though I think the B/S allows Fannie to handle the senior preferred without too much difficulty, the warranty takes away 80% of the market value.

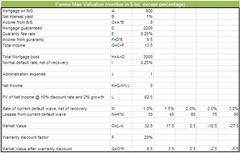

A Quick Valuation

Here’s a ballpark calculation of Fannie’s fair market value.

As you can see, it is the worst case scenario. I assumed 1% net interest yield, 0.25% net credit loss rate that unfortunately cancelled out all of $2.2 tril mortgage guaranty business, and 2% earning growth.

Even under such circumstance, it would stand 2% net credit loss from the $3 tril mortgage book, the advantageous credit condition and a turning housing market notwithstanding.

Here’s a blog link for the U.S. historical foreclosure rate. And historically, 2% net credit loss seems high.

Fannie or Freddie?

Good question. I’m too tired to figure out.

Conclusion

Loading up!

If you are tooooooo tired to figure out, then have a rest.

ReplyDeletePlus: love and kisses from Apple 177