A. C. Moore is an art & crafts specialty retailers operating 135 stores on the east coast. It sells all kinds of materials and tools for scrapbooking, painting, sewing and quilting, needle works, knitting and crocheting mainly to middle aged women. The sales of 2007 was $560 million, or $4 million per store. The company earned $4 million that year.

When the Great Recession hit, sales dipped 5% in 2008, then another 16% in 2009. Consequently, it lost $26 million in both years.

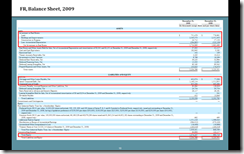

The stock is very cheap right now, at $2, with a market value of $51 million. The balance sheet is quite healthy. With $31 million in cash, $19 million short-term debt, and $41 million in land and buildings, it seems a Ben Graham stock. In other words, the company is worth at least 20% more than the trading value and then some if liquidated immediately.

The problem is, of course, how to turn it profitable again. Lacking necessary information, I would not be able to judge the level of difficulty of doing so.

The gross margin is 40% though, meaning it has an unusually big overhead. Maybe it would help you make some sense of the operational efficiency. Is it a scale issue, or cost management, or any other standard retail problems? I have no idea.

However, if you are a customer who thinks the price in A. C. Moore’s store is reasonable, its product quality superior, store staff are helpful and knowledgeable, and the economy is getting better, you may consider buy some of its shares.

There is margin of safety. You cannot be far off.