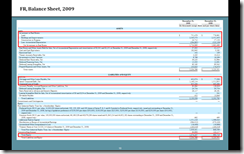

First Industrial holds and rents a portfolio of industrial properties—factories, warehouses, etc. The book value of the properties was $2.7 billion, financed partly by $2 billion debt. The book equity was $1 billion, or 3X market value. There was unexpectedly no write-downs in assets.

Cheap as it is, what’s interesting is its profit model. As the I/S shows, in recent years it had scant gains from the renting business. Instead, all its profits came from selling properties for higher prices.

It rolled over 30% of its properties and made $250 million from price appreciations, and 20% for $180 million. Such an earning stream stopped in 2009 together with a single-digit drop in rent revenues, pulling the company down into read.

CRE usually lags and its bottoming is hard to predict.

If you want to buy its shares, it would be the very reasonable price. If the valuation recovered to only half of current book value—not a scenario unthinkable—the stock would jump 40%.

Cash from operations would be positive before the revenue is cut by half.

No comments:

Post a Comment