If you have a long investment horizon (i.e., many years before being eligible to receive social security checks), get your money out of money market and load up on General Electric.

“But GE has just been downgraded!” Stop! Listen to me and I will tell you why.

Share Performance

Its share price dropped 70% in last year, a clear winner vs. S&P 500 in the race to the bottom. The market value is $114 bn, or 6X earnings.

The Business

Here’ a summary of last five years’ income statement by segments.

A caveat emptor first: I don’t know anything about the business of General Electric, except than I was using a GE microwave oven and that it owns GE Capital, which is a bank.

The Valuation

Anyway, tell you how I put up with a price.

The company has five segments – energy infrastructure, technology infrastructure, NBC universal, capital finance and consumer & industrial. The capital finance part is the bank.

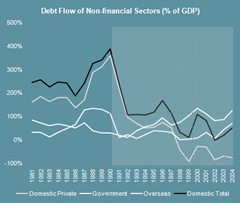

Banking business is quite fishy these days, so I will give the capital finance segment ($8.6 bn profit ‘08, 10X leverage) out for free; The consumer & industrial part ($365 mn profit ‘08) is small compared to the other segments, I will also give it out for free.

The rest three segments (again, I don’t know what they are doing) had a combined profit of $17 bn ‘08. By the current market value, it gives a P/E of 6.7.

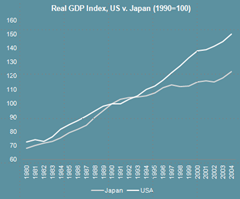

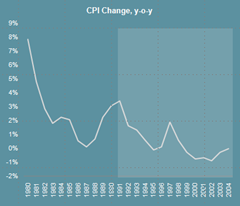

Now suppose that the economy is really bad in the next two years (C’mon, even Google is laying off people), and those three segment makes zero profit in ‘09 and ‘10, then return to the ‘08 profit level in ‘11 and grow in line afterwards with the U.S. GDP at 3.5% (2.5% real growth plus 1% inflation).

If you discount the earning stream at 10%, the P/E would be 1/(10%-3.5%)/(1+10%)^2 = 13X, or a market value of $221 bn, about 200% of the current.

You may say that “hey wait a minute, that’s not cash.” Let me tell you this: GE had a historical dividend payout ratio of 80%, or so I heard. Take a 80% discount if you wish to.

Besides, I seriously think the growth rate is underestimated. Here’s a part 10-year summary: The CAGR of earning growth was a solid 6%.

Besides, don’t forget that I gave you GE Capital and Commercial & Industrial for free. Besides, I wiped the rest’s earnings out for two years.

A Comparison

Admittedly, there are many earning-depressed quick picker-uppers out there these days, but GE is obviously one of the worst (see above).