Economies grow – they generally do, albeit recessions.

Today’s recession is by all accounts a severe one. Talking heads like to compare it first to the Great Depression, then to Japan’s Lost Decade. This time I shall tell you about the latter one.

Introduction

The Japanese economy had a tremendous growth after WWII, a period referred to as the Miracle of Japan. During the 80s the Japanese seems to be winning in all economic fronts – the Japanese auto companies are beating up the Detroit Three (and unfortunately they still do) – so that there are predictions that Japan would soon surpass the United States to become the #1 economic power.

Then suddenly it crashed. The crash led into a prolonged stagnation, now called the Lost Decade.

What Happened

I will give you some facts and figures of the Japanese economy from 1980 to 2004. What I found is reminiscent of what we are experiencing today and quite scary. I hope you can tell me why.

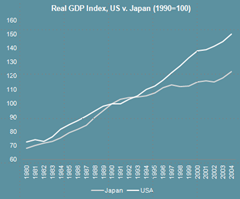

From 1980-90, real GDP expanded 3.9% CAGR; from 1991-2004, it was 1.4%.

If I tell you that the U.S. growth rate was 3.1% from 1991-2004, it may not seem a huge difference, right? But the mere 2% resulted in a 25% lead over years.

The Japanese economy added literally no jobs during that period.

What triggered the downturn was a spectacular double bubble burst of the stock market and the real estate market.

Bank of Japan, the central bank, has cut discount rate towards zero, so that everybody would use it as an example for the Liquidity Trap.

Business borrowing cost dropped along the way and corporate borrowing was almost free (it may be a bit more complicated).

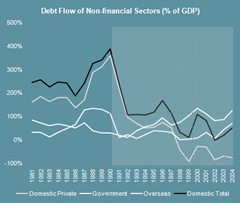

The government spent quite a bit on deficit as well. Today its Debt/GDP ratio is among the highest.

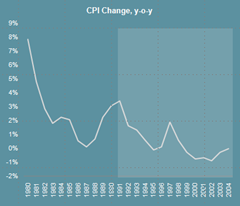

A mild deflation (decrease of price level) was allowed to happen – a bad thing according to most people.

There was a severe credit contraction: the government was borrowing big on top of the net debt outflow from the private sector.

Businesses profitability hurt a bit.

They stopped investing in production capacity (?).

Financial institutions plunged into and stayed in trouble.

Lessons Learned

I am ok with recessions - who doesn’t catch a cold from time to time? You can usually walk it off. But a recession of a decade? No way.

The scary part of this episode is that it reminds us of today: double asset bubble burst, credit contraction and deleveraging, troubled financial institutions, dampened corporate profit, zero interest rate and whatnot – and it’s global. Who knows whether we would end up into a Lost Decade of the World?

Heck, let’s have an hyper-inflation.

No comments:

Post a Comment