Adding BKC to my portfolio. This is a quick valuation note.

Share Performance

YTD, BKC has seriously underperformed the market and its peers.

Note that the share price nosedived in April and the price just stayed there. The only reason I can find for the drop was a sales miss.

Current market value $2.4 billion.

The Business

From AR 2009:

“[..]Our restaurant system includes restaurants owned by the Company and by franchisees. We are the world’s second largest fast food hamburger restaurant, or FFHR, chain as measured by the total number of restaurants and system-wide sales. As of June 30, 2009, we owned or franchised a total of 11,925 restaurants in 73 countries and U.S. territories, of which 1,429 restaurants were Company restaurants and 10,496 were owned by our franchisees. Of these restaurants, 7,233 or 61% were located in the United States and 4,692 or 39% were located in our international markets. Our restaurants feature flame-broiled hamburgers, chicken and other specialty sandwiches, french fries, soft drinks and other affordably-priced food items. During our more than 50 years of operating history, we have developed a scalable and cost-efficient quick service hamburger restaurant model that offers customers fast food at affordable prices.

We generate revenues from three sources: retail sales at Company restaurants; franchise revenues, consisting of royalties based on a percentage of sales reported by franchise restaurants and franchise fees paid to us by our franchisees; and property income from restaurants that we lease or sublease to franchisees.”

The Financials

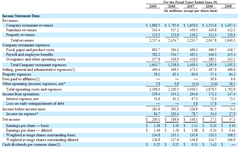

I/S 2009:

Comparable sales growth:

There’s a $755 million debt and $122 million cash on the B/S.

The Valuation

EV/OpIncome = ($2.4 billion market-based equity + $0.6 billion debt) / ($0.34 billion operating income) = 8X.

P/E = $2.4 billion / $0.2 billion =12X.

Conclusion

If you like a medium term 8% C/D with growth potential, you’d like owning BKC.

Whatnots

Should find out peer performances.

No comments:

Post a Comment