Adding PDE to my portfolio. This is a note.

Stock Performance

1 year performance compared to SP500:

The Business

Pride is “one of the world’s largest offshore drilling contractors operating, as of February 2, 2009, a fleet of 44 rigs, consisting of two deepwater drillships, 12 semisubmersible rigs, 27 jackups and three managed deepwater drilling rigs. We have four deepwater drillships under construction. [..] customers include major integrated oil and natural gas companies, state-owned national oil companies and independent oil and natural gas companies.”

It wins drilling contracts thru competitive bidding and earning daily fees for drilling services.

Pride is continuously focusing on deepwater drilling and is spending capitals accordingly.

Profit margin is good, though those of some competitors (RIG, NE) seems higher.

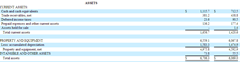

Looking at B/S, the company has $5 billion PP&E (I guess mostly boats, docks and related), so NI/PP&E is about 10%.

Valuation

Market cap is $4.5 billion, or 10X 2008 net income. Net debt is zero. It’s at fair value assuming 10% required return and no growth. But running at full capacity and recent capex indicates some growth.

Whatnots

Tax rate is unusually low. Treatment for oil drilling businesses?

No comments:

Post a Comment