Monday, October 12, 2009

Friday, October 2, 2009

Portfolio Note: CIT @ $1.21 - Sell

Sold CIT on the memo.

Bought at $0.70, cashed out half at $1.46 and the rest at $1.21 today. All in less than three months.

Thursday, October 1, 2009

Portfolio Note: CEP @ $3.98 - Buy

Constellation Energy Partners (CEP) is a nat gas production company.

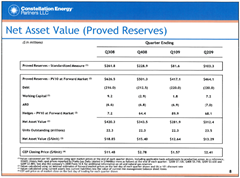

From the 2Q conf call: the NAV of proved reserve was worth $312.4 million, while the current market value is $88 million. The calculation values reserves at about $2/mmBtu, so I assume it deducted production costs.

From 10Q of Q2/2009, CEP hedged around 3/4 production at above $8.

It generates $9 million free cash in 1H.

Known unknowns?

Wednesday, September 23, 2009

Portfolio Note: TSCM @ $2.79

The current market cap of TSCM is $83.6 million.

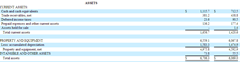

Now look at the B/S in 10Q as of March, 2009.

The most recent 10Q is not out yet.

What’s wrong?

Wednesday, September 9, 2009

Portfolio Notes: Adams Golf (ADGF) @ $2.85 - Buy

Buying ADGF.

The B/S is a good enough reason.

The shares are traded at 0.4 P/B. In other words, if the inventories/receivables are liquidated at discount, paying out all the payables, it’s worth a lot more than the current $18 million market value.

A classic Ben Graham stock, hard to find these days.

The down side is its low trading volume, maybe wide bid/ask spread. The $18 million market cap may have put it under the radar of most stock screeners.

Tuesday, September 8, 2009

Portfolio Notes: UNG – Speculative Buy

This is a note on United States Natural Gas Fund, or UNG, an ETF of nat gas futures that I recently added to my portfolio.

The only reason I am buying UNG is that the nat gas spot price is out of whack comparing to historical level.

The annual inventory level has been stable over the years, while fluctuating seasonally. The spot price, not inflation adjusted, was down to $2 during the 2001-02 recession, but quadrupled 1.5 years later. I thought it may happen again.

This is all I know about the U.S. nat gas market. It is admittedly a speculation, with the disadvantage of a contango in nat gas future.

Portfolio Notes: Burger King (BKC) @$18.10 - Buy

Adding BKC to my portfolio. This is a quick valuation note.

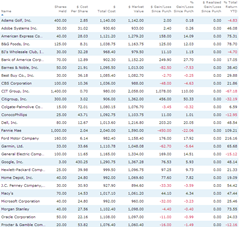

Share Performance

YTD, BKC has seriously underperformed the market and its peers.

Note that the share price nosedived in April and the price just stayed there. The only reason I can find for the drop was a sales miss.

Current market value $2.4 billion.

The Business

From AR 2009:

“[..]Our restaurant system includes restaurants owned by the Company and by franchisees. We are the world’s second largest fast food hamburger restaurant, or FFHR, chain as measured by the total number of restaurants and system-wide sales. As of June 30, 2009, we owned or franchised a total of 11,925 restaurants in 73 countries and U.S. territories, of which 1,429 restaurants were Company restaurants and 10,496 were owned by our franchisees. Of these restaurants, 7,233 or 61% were located in the United States and 4,692 or 39% were located in our international markets. Our restaurants feature flame-broiled hamburgers, chicken and other specialty sandwiches, french fries, soft drinks and other affordably-priced food items. During our more than 50 years of operating history, we have developed a scalable and cost-efficient quick service hamburger restaurant model that offers customers fast food at affordable prices.

We generate revenues from three sources: retail sales at Company restaurants; franchise revenues, consisting of royalties based on a percentage of sales reported by franchise restaurants and franchise fees paid to us by our franchisees; and property income from restaurants that we lease or sublease to franchisees.”

The Financials

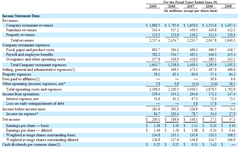

I/S 2009:

Comparable sales growth:

There’s a $755 million debt and $122 million cash on the B/S.

The Valuation

EV/OpIncome = ($2.4 billion market-based equity + $0.6 billion debt) / ($0.34 billion operating income) = 8X.

P/E = $2.4 billion / $0.2 billion =12X.

Conclusion

If you like a medium term 8% C/D with growth potential, you’d like owning BKC.

Whatnots

Should find out peer performances.

Portfolio Notes: Simon Property (SPG) @ $63.5 - Dunno

This is a quick valuation of Simon Property (SPG). It’s the first REIT I looked at.

Stock Performance

$18 billion in market value. In 2008, Simon distributed $852 million in dividends.

What It Does

From 2008 AR:

“Simon Property Group, Inc. [..] own, develop, and manage retail real estate properties in five retail real estate platforms: regional malls, Premium Outlet Centers®, The Mills®, community/lifestyle centers, and international properties. As of December 31, 2008, we owned or held an interest in 324 income producing properties in the United States, which consisted of 164 regional malls, 70 community/lifestyle centers, 16 additional regional malls and four additional community centers acquired as a result of the 2007 acquisition of The Mills Corporation, or the Mills acquisition, 40 Premium Outlet Centers, 16 The Mills, and 14 other shopping centers or outlet centers in 41 states plus Puerto Rico. [..] We also own interests in four parcels of land held in the United States for future development. In the United States, we have one new property currently under development aggregating approximately 400,000 square feet which will open during 2009. Internationally, we have ownership interests in 52 European shopping centers (located in France, Italy, and Poland); seven Premium Outlet Centers located in Japan, one Premium Outlet Center located in Mexico, one Premium Outlet Center located in Korea, and one shopping center located in China. Also, through joint venture arrangements we have ownership interests in the following properties under development internationally: a 24% interest in two shopping centers in Italy, a 40% interest in a Premium Outlet Center in Japan, and a 32.5% interests in three additional shopping centers under construction in China.

We generate the majority of our revenues from leases with retail tenants including: Base minimum rents; Overage and percentage rents based on tenants' sales volume; and Recoveries of substantially all of our recoverable expenditures, which consist of property operating, real estate taxes, repair and maintenance, and advertising and promotional expenditures.”

It’s one of the largest REITs and a Fortune 500.

How It Makes Money

As you can see in the above I/S 2008, it develops and maintains shopping malls and earns rents from retailers.

A further breakdown of revenue source in the U.S. as follows:

Now look at the B/S:

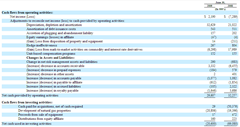

Net investment properties ($19 billion) are almost 100% financed on debt ($18 billion), around $4 billion of which rolls over each year (see C/F statements in the later part).

Funding details as follows:

Weighted average financing cost is about 5.12% in 2008.

There’s additional debt taken by unconsolidated JVs.

The B/S composition leads me to the C/F statements:

You can say that it’s highly leveraged, with a strong operating cash flow.

A Quick Valuation

So here’s the story: Simon develops malls, financing all by mortgage and earning rents on them. The value is generated thru the race between ROA and funding cost (think bank).

The 2008 CF from operations was $1.6 billion after paying $1 billion interest on mortgages. CapEx 2008 was $874 million (see below).

So that in 2008 Simon generated $2.6 billion on invested properties of $19 billion, and ROA was roughly 2.6/19 =14%. Financing cost was a little above 5%. Net return was 14% – 5% = 9%. Not too bad.

An justification of the market value: on $1.6 billion CF from operations in 2008, if assuming 10% required rate of return and 2% growth, we have a P/CF of 12X, which leads to a market value of 1.6*12 = $19.2 billion, or 6% above the current market value of $17.9 billion. Remember that such valuation assumes Simon continues to financing all its properties thru debts.

There’s however risks. First is the financing cost. If mortgage rate increases by 1%, it takes away $200 million or about 12% from cash flow. Could Simon increase rents accordingly? Second, consumer spending, hence retailer income, is still depressed.

Simon’s 10Q of 2Q09 is showing both:

Funding cost was up around 0.5%..

..and rents are deteriorating.

Revenue of 1H09 was flat.

Conclusion

It seems to me that at the current state of economy Simon’s return does not justify the risks.

Alas, Mr. market thinks otherwise. At this moment, it is up 3.65% today.

Whatnots

- REITs seems having a special tax treatment: only paying corporate income taxes after dividends (see link here)

- Insignificant amount of preferred, convertibles on the B/S.

Wednesday, September 2, 2009

Portfolio Notes: Pride International (PDE) @25.68 - Buy

Adding PDE to my portfolio. This is a note.

Stock Performance

1 year performance compared to SP500:

The Business

Pride is “one of the world’s largest offshore drilling contractors operating, as of February 2, 2009, a fleet of 44 rigs, consisting of two deepwater drillships, 12 semisubmersible rigs, 27 jackups and three managed deepwater drilling rigs. We have four deepwater drillships under construction. [..] customers include major integrated oil and natural gas companies, state-owned national oil companies and independent oil and natural gas companies.”

It wins drilling contracts thru competitive bidding and earning daily fees for drilling services.

Pride is continuously focusing on deepwater drilling and is spending capitals accordingly.

Profit margin is good, though those of some competitors (RIG, NE) seems higher.

Looking at B/S, the company has $5 billion PP&E (I guess mostly boats, docks and related), so NI/PP&E is about 10%.

Valuation

Market cap is $4.5 billion, or 10X 2008 net income. Net debt is zero. It’s at fair value assuming 10% required return and no growth. But running at full capacity and recent capex indicates some growth.

Whatnots

Tax rate is unusually low. Treatment for oil drilling businesses?

Fannie Mae @ 1.48: A Review

I called on Fannie Mae (FNM) on August 30th and is down 28% since then. This is a review.

Conclusions first: Extremely risky as it is, I still believe Fannie is a good buy value-wise. I would be buying more when the sell-off wanes.

What worry you most would be the charge off and the potential government actions. While 2% net charge off would demise Fannie as I stated earlier and the possibility is higher than I initially thought after digging deeper, what the government would do about it put it into high volatility. I cannot predict the latter. Here is an example.

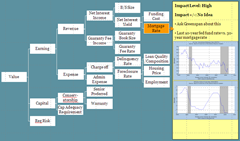

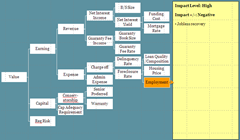

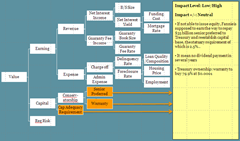

Value Drivers of Fannie

Tuesday, September 1, 2009

Sunday, August 30, 2009

Fannie Mae @ $2.04

This is a quick valuation of Fannie Mae (FNM).

Stock Performance

The market value of Fannie has been almost wiped out by the Great Recession (who dubbed it?) .

Recent performance has been strong however and it caught my attention – usually I like seeing plummeting stock prices because ascending price of stocks I don’t own feel like a loss. Greed…

The market cap was $2.4 bil as of last Friday.

What It Does and How It Makes Money

The short answer is I have no idea, but this is what I will tell you if I try: it buys mortgage loans from 1,000 banks, thrifts, credit unions, and other mortgage originators, packs them into MBSs (mortgage backed securities), and then distributes them back into the market (the so-called securitization process) as well as keep some on its own book.

It makes money in primarily two ways:

1) for the mortgage loans/securities it keeps on its own book, it earns the net interest yield, i.e., the interest spread between the interest it collects from the mortgages and the funding interest it pays.

2) for the MBS securities it distributes out, it collects a guaranty fee by presumably guarantees the return, as in an insurance policy.

In both cases, it has to face the default risk when borrowers cannot repay its mortgages.

The above is a 5-year financial summary.

What’s worth noticing first is the sheer size of its mortgage book – around $800 bil held on the B/S and another $2.2 tril guaranteed, or $3 trillion in total. It represents earning power as well as risks, so that if 1% is written off, it’s $30 bil loss.

The next thing is the net interest yield and guaranty fee rate, both of which have been trending down before trending up. It’s a long story to explain the swing. But anyway, the 2008 net interest yield was 1.03%, and guaranty fee rate was 31 bps (or 0.31%).

2008 Losses

A key question of the valuation is how much losses Fannie would incur before the mortgage market normalizes. It’s hard to define what the norm is, but we shall look into the $60 bil loss in 2008 for some clues.

A break-down of the big item 2008 losses: $7 bil in Investment losses, $20 bil in Fair value losses and $30 bil in Credit-related losses.

The 2008 A/R says that the $7 bil investment losses was all due to sub-prime and Alt-A. I will assume it would not happen again in the recent future.

The $20 bil fair value losses was primarily due to interest rate swap, in which Fannie locked in the funding rate to mitigate interest rate risk before the market rate fell. It’s a loss on opportunity cost and it can be factored into the valuation through net interest yield.

The true loss came from the $30 bil credit-related losses, caused by the recent housing market turmoil and reckless lending/borrowing. Though it was about 0.83% of total guaranty book, the 20.76% nonperforming loan ratio was frightening.

2009 1H Losses

Fannie lost another $38 bil in the first half of 2009. Brutal as it was, the glimmer of hope is that the net interest yield improved to 1.69%, and credit-related losses stabilized in the second half.

Conservatorship

Fannie Mae is currently under conservatorship. Financially, it means that the Treasury Department owns $35 bil senior preferred along with warranty to purchase 79.9% of common at zero cost ($0.0001 to be exact).

Though I think the B/S allows Fannie to handle the senior preferred without too much difficulty, the warranty takes away 80% of the market value.

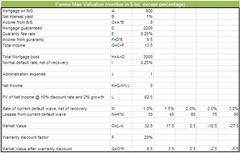

A Quick Valuation

Here’s a ballpark calculation of Fannie’s fair market value.

As you can see, it is the worst case scenario. I assumed 1% net interest yield, 0.25% net credit loss rate that unfortunately cancelled out all of $2.2 tril mortgage guaranty business, and 2% earning growth.

Even under such circumstance, it would stand 2% net credit loss from the $3 tril mortgage book, the advantageous credit condition and a turning housing market notwithstanding.

Here’s a blog link for the U.S. historical foreclosure rate. And historically, 2% net credit loss seems high.

Fannie or Freddie?

Good question. I’m too tired to figure out.

Conclusion

Loading up!