I sift through my blogroll and concluded that the Geithner’ plan, the Public-Private Investment Program (PPIP), is a great deal for banks, a so-so deal for private investors, and a bad deal for tax payers. My earlier post could be wrong.

Here is why:

Asymmetric Information and the Lemon Problem

Under the legacy loans program, “Banks identify the assets they wish to sell.” It is like buying a used car: all problems emerges only after the purchase. And the banks have incentive to put the most troubled ones on the market without adequate disclosure. The result is that the investors would tend to overpay.

The Winner’s Curse

The assets would be auctioned, and auctions leads to the Winner’s Curse – who overvalues win the bids.

In other words, bidding wars lead to overpaying. Besides, banks may have the option of not selling if the price is not right – a price floor.

Leverage Aided Risk Taking

Consider a portfolio of 2 possible payout: $10 or $30, each at 50% probability. Without leverage, your willingness to pay (WTP) is $20, if you are risk neutral.

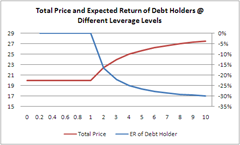

When the leverage kicks in, it drives up the total price since when the investment goes busted the debt holders would be left holding the bag. At the same time, the FDIC guarantee reduces the risk aversion of debtors.

The higher the leverage, the higher the price (which is decided by bidders) and the expected loss of debt holders.

Potential for Fraud

Suppose a bank has a loan portfolio worth 20 cents on a dollar. It may collude with some guy to take advantage of the plan. For example, it may give a loan of 10 cents to a bidder, bidding the portfolio off at 80 cents with 70 cents from government (60 cents debt and 10 cents equity), so that it sold a 20-cent problem for 70 cents (80 cents selling price – 10 cents loan). Criminals.

Opportunity for Improvement

The overall problem is that investors tend to overpay with or without purpose, while the government is skewed on the risk side. Thus it requires that the government be a good loan officer to safeguard the taxpayers. To do it, the authorities have to know the fair value of all what are put on the market and monitoring the auction results. If the price seems over-realistic, it has to step in and veto – a price ceiling.

On the other side, it should not allow sellers to pull back – must sell at the auction price regardless of the results, provided there are plenty of participants – otherwise there won’t be a market.

A Herculean task, easier said than done.

No comments:

Post a Comment