The world is becoming an increasingly crowed place. “It’s a small world,” as some would say.

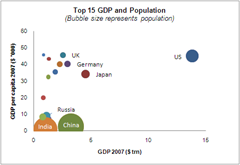

Global GDP and Population

According to UN’s Population Division (yes, there’s one), the world population will double from today’s over 6 billion to 12 billion in 2050, based on medium variant estimation.

Besides Asia, which has over half of the population, there’ll be a lot of people in Africa.

I remembered from the other day that some guy on TV said we would need four planet earths (another three other than what we have) to maintain the current living standard for all population. Not the exact quote, but roughly so.

One candidate is Mars – a 55-100 million km, eight-month trip. Book your ticket earlier and bring warm clothes.

The on-going depression also reminds us the GDP. The global GDP is around $55 trillion, a number that I neither care for nor could make any sense of. Besides, there are various accounts of it.

One reason causing the discrepancy is national currencies and exchange regimes. Appreciate you currency 5% and you get a 5% GDP hike in US dollars. Trouble. An international currency may have some merits after all.

Someone dubs the U.S.-China president meeting in the London G-20 summit as G2. It is well-grounded: both nations are a quarter important worldwide, and the difference is the U.S. get a quarter of global GDP, while China gets a quarter of the population.

A More Connected World

Check out UNWTO.

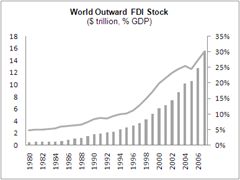

Moneywise, nations are linked via trade and capital flow (that includes financial assets or FDI). They grow much faster than GDP.

Trade

Global one-way trade is approaching 30% of GDP, leading to the famous global imbalance problem.

Portfolio Investment

Thanks to the global capital market and ETFs, you can own a piece of everything with your IRA – Brazilian equities, Japanese Yens, oils and soybeans, Spain sovereign bonds, you name it.

The cross-border financial asset holding is reaching 80% of global GDP. The source and use of money is correlated with national GDP level, though more dispersed today.

Moien, Luxembourg.

FDI and MNCs

Another way to throw money abroad is by foreign direct investment (FDI), which is approaching 30% global GDP.

Europe is the most active region. Merci, Euro.

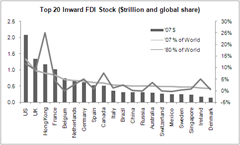

As you can expect, money is flowing from the developed to the developing. (Notice Hong Kong, Wannechglift.) Through a chain of M&As, you can build a global business empire. You can compare the Fortune 500 list with the country GDP list.

Now China is the FDI receiver - As always, the rich becomes richer.

MNCs in China are increasingly active..

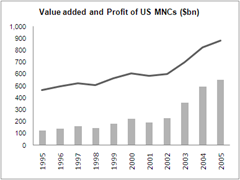

.. and profitable.

The U.S. is one of the most active global empire builders.

Can China do that one day instead of hoarding treasury bills?

Addi or a voir.

No comments:

Post a Comment