This is a preliminary note on the very unique Chinese banking system, with a focus on the monetary operations.

The Chinese Banking System

China doesn’t have a well developed and sophisticated capital market and financial system. No pains, no gains.

Though constantly evolving, the perception is that Chinese banks are more of the old-day bank-at-the-street-corner type. They take deposits and make loans or buy government bonds. No securitizations, no excess derivatives.

The total assets of the financial sector is of RMB 50 trillion in size (1.7x GDP), over 90% funded by deposits. Market shares are concentrated. The big four – ICBC, ABC, BOC and CCB – controls over half of the assets, and the major shareholder of those four is the Chinese government.

Yes, the banking system is nationalized, in good times and bad, and it works in its own way. No free market, supply and demand mechanism for interest-bearing loans and securities: the central bank, PBoC, sets the entire ladder of interest rate, from that of deposits to loans.

Sounds like a boring, stable, socialist banking system, right? Oh, except the astonishing rate of non-performing loans (NPLs).

It was about 20% at its peak, though the situation is improving in recently years. At such a level, banks are easily bankrupt despite of hefty fee collection due to lack of competitions. An example here. I don’t know how they did that – it’s not easy. One possible explanation is that it’s policy-driven. More on this later.

But the good news is that banks are nationalized, so that the government is there for bail-outs, in good times and bad. No FDIC type of deposit insurance necessary.

PBoC’s Ever-expanding Balance Sheet, Reserve Ratio and Sterilization

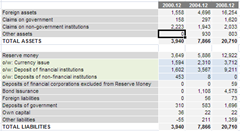

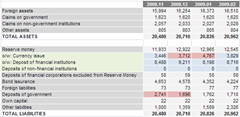

Monetary policy is a completely different craft in China. Take a look at PBoC’s balance sheet and you would know why.

What drove the rapid balance sheet expansion is China’s foreign reserve accumulation, topping $2 trillion today. Besides causing trade tensions, safety concerns and controversies, the current account surplus pile-up is rather a headache for PBoC: it floods China with money and threats with inflation.

How is PBoC fighting against it? They do two things – reserve ratio escalation and sterilization.

The above is the deposit reserve ratio (a portion of banks’ deposit money kept with the central bank to control the upper limit of credit). It is climbing up, until later last year.

The other one is the bond issuance by PBoC to sterilize money supply, or to take money out of the marketplace. It totaled over RMB 4 trillion – not a negligible amount and it would keep ascending as long as there is CA surplus.

There’s another possible way – to spend it. It is an incredible amount of money to spend. I did some long posts on it.

An Example: Stimulus Package in Chinese Way

Remember China’s RMB 4 trillion stimulus package? (Admittedly, I didn’t do the homework well.) It’s a perfect demonstration of how powerful the system is.

Amazingly, it seems happened overnight, and no known complaints.

It is still developing and the result is yet to be seen. I might well be wrong.

Will PBoC be Insolvent?

Sounds like a crazy question, since it prints money (not exactly) freely. But it doesn’t hurt to contemplate either.

One issue is the exchange rate. I don’t know how exactly they do the book-keeping on the foreign assets (mainly foreign reserves, plus some gold and others), but notice that RMB has been appreciating. If marked to market, the decreasing value of the foreign assets would drag the net worth underwater. Funny, since PBoC sets exchange rate and they are doing so to bankrupt itself. If there’s an outflow, it would be cash-based.

Another issue is interest rates that determines the income statement. PBoC collects interest payment mainly from foreign assets and pays out on deposit reserve and bonds. If (well-controlled) domestic interest rate is higher than foreign, it eats into the capital. As you can see, not much is left.

It’s not risk free, after second thought.

Does it matter and what to do?

No comments:

Post a Comment