Suppose you are a maize farmer. I buy some maize from you with some money. Just another day in life, right?

What if I tell you that the money I pay you is not your kind of money, but my money, which I can print as much as I want to? Would you hesitate to accept that money?

Furthermore, you cannot really use that money, and you have to deposit it at a bank. Guess who is the bank? It’s me, and I set the interest rate.

Would you still selling the maize to me? Few will. But that’s more or less what the US is doing to many nations, especially those in Asia. China accumulated $2 trillion by exchanging goods with the United States for paper money that the country printed.

In this article, I will show you all sides of the story behind it.

The Dollar and US/China Imbalance

Money flow among countries via trade (of goods and services) and investment (in financial or hard assets). If you pay more and receive less, you are running a current account deficit.

The problem is countries have their own money, and it has caused headache for hundred of years because of the exchange rate and its related bunch of troubles. The consensus today is that dollar is the major international currency, so that countries write checks to each other in dollar.

Why dollar, you may ask? Well, it used to be gold, and the one with dollar is kind of a long and unpleasant story. The gist is counties don’t trust each other too much when it comes to printing money, and the United States is relatively a reliable one (and more importantly a rich one). Some country like Ecuador even gave up its own currency and dollarized (meaning they use the US dollar as their official local currency) – must have a lot of fond memories. On the other side of the Atlantic Euro is becoming a regional currency, with advantages and disadvantages.

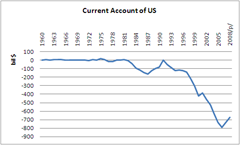

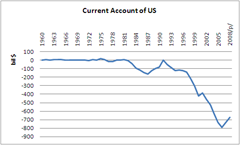

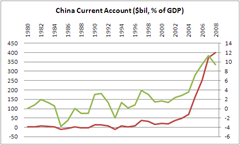

Anyway, the United States has been running a current account deficit in recent years (chart below). The ‘08 number is $673 billion, around 5% of GDP. Among them $306 billion is with China.

So that along the way China is piling up US dollars. It’s almost $2 trillion as of today.

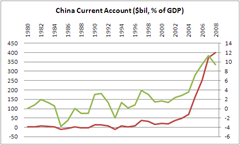

Now take a look from the China side.

In contrast to the United States, China is running a surging current account surplus, currently at $400 billion, or 10% of GDP.

What’s Driving China’s Trade Surplus?

The above chart may give you some clue. If you organize China’s foreign trade by type, you can see that the regular trade is almost balanced; there’s a deficit in other trade (I don’t know what that is); the processing trade (i.e., importing raw materials or components, assembling, then re-exporting the finished products) is shooting up through the roof.

Another way to look at the trade data is by type of corporations. The above shows the February's import/export data of state owned, foreign owned enterprises: 60% of export is by foreign owned. (BTW, the yoy trade volume dropped over 20%.)

So here’s the story: foreign companies have established manufacturing facilities in China for processing goods and re-export. If you are like me, you would be wondering why….

Should RMB Appreciate?

Some guy accused China for manipulate currency and urge China to appreciate RMB. Is it justified?

The above is the historical exchange rate of RMB/USD. It used to be that RMB 2 was worth $1. (Really?) In recent years RMB’s been gradually appreciated.

Like many Asian countries, the Chinese authority pegs the RMB to USD, meaning the government decides and maintains the exchange rate. The other kind of exchange regime is float exchange rate, in which it’s decided by the market.

So is China cheating by setting the exchange rate too low (so that Chinese goods are cheaper and thus more competitive)? It is a rather complicated value judgment, but I will tell you what I think.

First it’s about the price level discrepancy among countries. There are measures comparing price levels among countries, and the major one is Purchase Power Parity (PPP).

The above is an international comparison of PPP-based GDP per capita and price levels (hint: find Iceland, the allegedly recently bankrupted country). The rule of thumb is that the higher PPP-based GDP per capita (consider it a measure of productivity) leads to higher price levels. In other words, low-income countries set the exchange rate low. And I don’t think all the low-income countries are running a trade surplus. The point is that by such a rule only (don’t ask me who sets the rules on what ground), trade surplus seems not the reason to justify currency appreciation.

Secondly, as I mentioned earlier the export driver of China is really the processing trade by foreign owned companies. Think a minute about how these companies operate. They import materials in USD, pay wages and expenses in RMB, export finished goods in USD for a profit (after wage and tax) also in USD.

If RMB appreciates, they have to pay a higher wage so that the cost would be higher. Although the reality is more complex, if there is another equivalent country with the same investment environment but lower cost level, they may plan to move. Would RMB then be depreciated again?

Thirdly, some evidence from Japan.

Japan depreciated Yen by half in the 80s to around 100:1 to USD and kept it there, but it’s been continuously running a trade surplus and current account surplus ever since. Price level induced by exchange rate may not be the only reason of trade imbalance.

Is It Good for China?

First of all, everybody says that free trade is good yet trade negotiation always fail. We live in a bizarre world.

In the case of China, consider the foreign owned enterprises and the resulting trade surplus a stimulus package. It creates jobs and boost local economy (the multiplier). As for the MNCs, they use China as a lower cost production center and selling goods at the same price at home. Consumers also benefit from low inflation. It seems a good deal for everybody.

There’s one problem though. The entire process creates total money supply around the world. It’s well depicted by Wu, the former chief of Foreign Exchange Management Agency. It’s a kind of asymmetric process, and I’ve raised the issue.

Is the Money Safe?

Is it safe to hold so much dollars? The Premier expressed his worry recently.

Fundamentally different from Russia or Mexico that defaulted on their sovereign debt (USD denominated), the United States would not – they can simply print money instead. Under such a guideline, I sold a bunch of CDS on the US treasury and booked a huge loss recently. How could it be?

Besides, the US GDP is 25% of the world (the EU another quarter). If that guy cannot pay his mortgage, what would be happening?

I guess the Premier is worried about inflation and with good reasons. Would there be inflation? I don’t really know. But I guess the time when we see inflation, It would probably be the time when we are out of the recession (though history says otherwise).

What Should China Do With the Money?

The Chinese government has been responsible with the foreign reserve assets. Still, it is a problem, ironically caused by having too much money – image you are a mutual fund manager just raised $2 trillion.

Currently the Chinese government holds most of the reserve in US treasury bills. Probably in an effort to diversify, China Investment Corp, a $200 billion, CDO-type sovereign wealth fund was created. Disappointingly, nobody knows what those guys are doing with the money (ponder this: whose money is it really?).

There is, however, another way to go: encourage the Chinese corporations to invest abroad.

(too tired, to be continued)

http://icecurtain.blogspot.com/